Millage rate calculator

You can improve your MPG with our eco-driving. One mill equals one-thousandth of a dollar.

Property Tax How To Calculate Local Considerations

L is the fuel filled in litres.

. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current. Enter your route details and price per mile and total up your distance and expenses. The first number after the decimal point is tenths 1 the second number after the decimal point is hundredths 01 and going out three places is thousandths 001 or mills.

Input the number of miles driven for business charitable medical andor moving purposes. 2020 Millage Rates - A Complete List. 800-232-7722 Toll Free 717-236-9526 Phone 717-236-8164 Fax.

How to calculate mileage with formula. For each mill levied on your. By using the initial rate the IRS set for 2022 as a.

Routes are automatically saved. From this we get to know that your mileage depends on. CompanyMileages Mileage Rate Calculator.

25 rows Mileage Rates. If the propertys appraised value is 250000 then a homeowner could perform the following calculation to determine their effective tax rate. If your millage rate is 2049 then you are paying 2049 in taxes for.

If the assessor determines that the. Assessed Value Mill Rate 1000 - The assessed value is 70 percent of the appraised fair market value determined by the assessor. Millage is the tax rate used to calculate your ad valorem taxes.

Millage Calculator If you need assistance using this tool please call 248-246-3201. One mil equals 1 for every 1000 of taxable property value. 30 mills 1000 003 millage rate.

Click on the Calculate button to determine the. The Rand McNally mileage calculator will help you determine the mileage between any two destinations. Select your tax year.

The number you calculate millage multiplied by taxable value tells you the property taxes owed before any credits. A mileage allowance for using a privately owned vehicle POV for local TDY and PCS travel is reimbursed as a rate per mile in lieu of reimbursement of actual POV. Mill rate or millage is a tax rate some municipalities use to determine their local property taxes.

We used the above findings from our analysis as the basis for our rate calculator. 2019 Millage Rates - A Complete List. Where KM is the distance driven in kilometers.

Thank you for your patience while we upgrade our system. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. 2018 Millage Rates - A Complete List.

2021 Millage Rates - A Complete List. IR-2022-124 June 9 2022 The Internal Revenue Service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. The millage rates would apply to that reduced number rather than the full.

Use the following mileage calculator to determine the travel distance in terms of miles and time taken by car to travel between two locations in the United States.

The Property Tax Equation

Tax Rates Gordon County Government

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Property Tax Millage Rate 13 Things 2022 You Need To Know

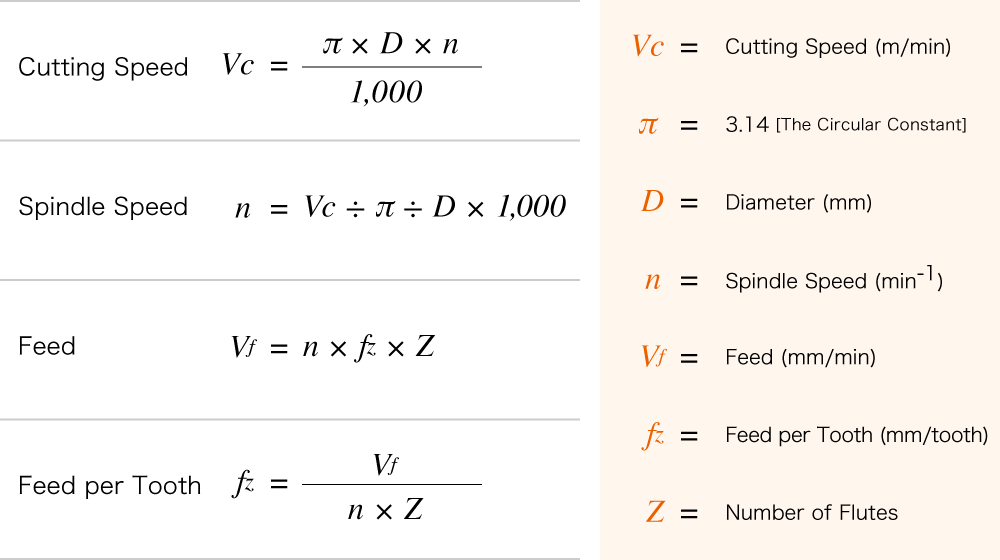

Calculation For Cutting Speed Spindle Speed And Feed Ns Tool Co Ltd

Property Tax Tax Rate And Bill Calculation

Property Tax Millage Rate 13 Things 2022 You Need To Know

Rhode Island Property Tax Rates Town By Town List With Calculator Suburbs 101

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Property Tax Calculator

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

New York Property Tax Calculator 2020 Empire Center For Public Policy

Millage Rates And Real Estate Property Taxes For Oakland County Michigan

New York Property Tax Calculator Smartasset

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet